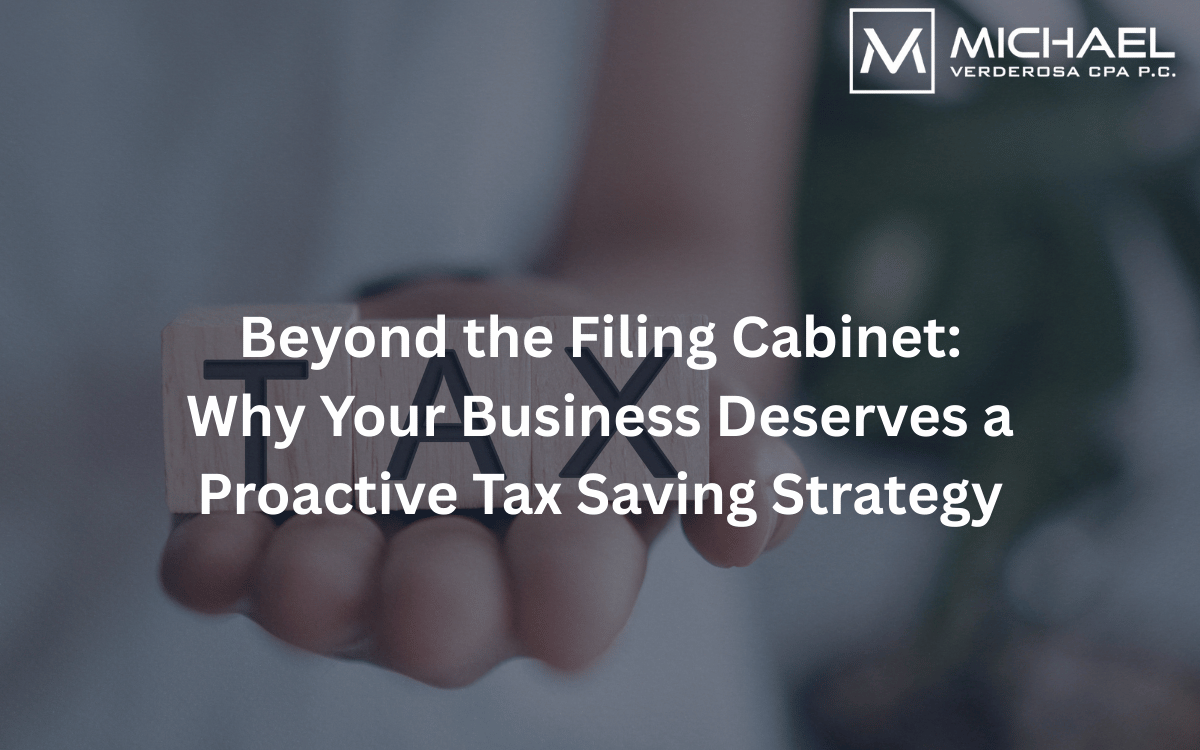

For many entrepreneurs, tax season is a time of high stress a frantic scramble to gather receipts followed by a “wait and see” approach to the final bill. Most settle for a traditional preparer who simply records what happened in the past. But if you are serious about scaling your operations and building personal wealth, you need to realize that your business deserves more than just basic compliance. It deserves a comprehensive plan crafted by a dedicated tax cpa accountant.

Think of your business like a high-performance engine. You wouldn’t wait for the engine to smoke before checking the oil; you perform preventative maintenance to ensure it runs efficiently for years. Strategic planning is that preventative maintenance. It’s the difference between looking in the rearview mirror and looking through the windshield. When you shift from a reactive mindset to a proactive one, you stop asking “How much do I owe?” and start asking “How much can I keep?”

The Hidden Cost of “Just Filing”

When you only focus on the act of filing, you miss out on the most powerful tools in the tax code. The code is not just a list of rules on how to pay the government; it is a roadmap of incentives designed to encourage business growth. However, these incentives require planning before the ball drops on New Year’s Eve. A small business accountant can help you navigate these windows of opportunity before they close, ensuring that your growth doesn’t lead to an unnecessary tax spike.

A proactive strategy looks at your entity structure, your retirement contributions, and even how you pay your family members. Many entrepreneurs are operating under the wrong entity type, such as staying a Sole Proprietorship when an S-Corp election could save them thousands in self-employment taxes. These aren’t “loopholes” they are intentional parts of the tax law that are only accessible to those who plan ahead with a qualified tax advisor for small business.

The Power of Industry-Specific Planning

Different industries have different “levers” they can pull to save money. We often see owners investing heavily in marketing and infrastructure to capture more leads and increase their billable hours. While this is great for the top line, the bottom line is what you actually take home to your family. By working with a tax cpa accountant, you ensure that as your revenue increases, your tax liability doesn’t spiral out of control. We look for ways to turn those business investments into optimized deductions that lower your taxable income.

Beyond just deductions, a true strategy involves “tax bracket management.” By timing your income and expenses, you can stay in a lower bracket even as your business grows. This requires a year-round relationship with your financial team, not just a once-a-year meeting in April. If you only talk to your professional when it’s time to file, the “moves” you could have made are already off the table.

Maximizing Every Dollar Spent

Every expense in your business should be working for you. When you hire a small business accountant, you are hiring someone to audit the efficiency of your spending from a tax perspective. Whether you are investing in new technology, hiring staff, or expanding your office space, each of these actions has a tax consequence. A strategist helps you time these events to provide the maximum benefit to your cash flow.

Another overlooked area is the “Home Office” or “Accountable Plan.” If you aren’t properly documenting how your business reimburses you for the use of your personal assets, you are leaving money on the table. A tax advisor for small business ensures that every dollar leaving your company is doing so in the most tax-efficient way possible, keeping more capital in your pocket for future investments.

Building Long-Term Wealth

The ultimate goal of a tax strategy isn’t just to save money today; it’s to build wealth for tomorrow. When you save $10,000 or $20,000 a year in taxes, that is money that can be moved into a high-yield retirement account or used to fund your children’s education. Over ten or twenty years, the “compounding effect” of tax savings can be the difference between a comfortable retirement and an uncertain one.

We want our clients to feel empowered. We want you to understand the “why” behind every financial move. When you understand the basics of how your taxes work, you can make better decisions as a CEO. You can decide when to hire, when to buy equipment, and when to expand your reach with confidence.

Conclusion:

If you are still waiting until April to find out how much you owe, you are essentially letting the IRS make your financial decisions for you. Your business deserves a partner who is looking out for your future, not just reporting on your past. It’s time to stop settling for “good enough” tax prep and start demanding the strategy your hard work deserves.

Moving your business from reactive to proactive ensures that you keep the maximum amount of your hard-earned profit. By aligning your goals with a forward-thinking plan, you turn your tax return from a source of stress into a tool for growth.

Author

Michael Verderosa

Michael Verderosa CPA, P.C. is a trusted certified public accountant based in New York City since 2011. He provide comprehensive services including tax preparation, bookkeeping, payroll, financial statement preparation, and advisory solutions for individuals and businesses.